var abkw = window.abkw || ''; More Than Half of U.S. Only Maryland levies both estate and inheritance tax. Unpaid income tax SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, The estate tax return is essentially a snapshot of the decedents assets at death, along with a summary of prior taxable gifts.

document.write('

document.write(' Therefore, if you pass away that year with an estate valued less than that amount, there is no estate tax liability.

Therefore, if you pass away that year with an estate valued less than that amount, there is no estate tax liability.  The reasoning: An orthodontist said it would correct the childs overbite. Tax Return Online: What are the pros and cons of filing your tax return from your phone or tablet. That includes 1,035,000 (911,162) for King Willem-Alexander, and a further 5.37m (4.7m) to pay for his staff and other expenses. In all six states, a surviving spouse is exempt from paying inheritance tax. Philippe, who acceded to the throne in 2013, received 12.5m (11m) in 2021, according to the Belgian governments latest report. Setting up a trust protects your inheritance from taxation. Remember that in most situations, no estate tax is due when someone passes away. From 1993, the monarch agreed to pay voluntary income tax, although they are exempt from inheritance tax, meaning the late queen passed her fortune to the king without any deductions for the public good. Estimate your family's expenses in case of your death Final expenses Final expenses Close Typically the greater of $15,000 or 4% of your estate.

The reasoning: An orthodontist said it would correct the childs overbite. Tax Return Online: What are the pros and cons of filing your tax return from your phone or tablet. That includes 1,035,000 (911,162) for King Willem-Alexander, and a further 5.37m (4.7m) to pay for his staff and other expenses. In all six states, a surviving spouse is exempt from paying inheritance tax. Philippe, who acceded to the throne in 2013, received 12.5m (11m) in 2021, according to the Belgian governments latest report. Setting up a trust protects your inheritance from taxation. Remember that in most situations, no estate tax is due when someone passes away. From 1993, the monarch agreed to pay voluntary income tax, although they are exempt from inheritance tax, meaning the late queen passed her fortune to the king without any deductions for the public good. Estimate your family's expenses in case of your death Final expenses Final expenses Close Typically the greater of $15,000 or 4% of your estate. Copyright 2023 1996-2023 Robert Clofine. Funeral expenses are included in box 81 of the IHT400. When our office handles an estate settlement, we prepare the estates income tax return and issue the Schedule K-1, and we time the payment of various expenses to minimize taxes and maximize these deductions. , capital gains, ordinary dividends, interest income from bank accounts and investments, royalties, business income, farm income and outstanding wages paid to the deceased person. Philippes father, King Albert II, who abdicated in 2013, receives 980,000 (862,635); Alberts eldest child, Princess Astrid, receives 341,000 (300,161), slightly more than her younger brother, Prince Laurent, who gets 327,000 (287,838).

In case the property needs to be sold, the executor

That includes 1,035,000 (911,162) for King Willem-Alexander, and a further 5.37m (4.7m) to pay for his staff and other expenses. Death Tax Deductions: State Inheritance Tax and Estate Taxes

The short answer is yes, an inheritance may be taxable, depending on a few factors. Any mortgage liability on real estate you own at your death also qualifies for an estate tax deduction. Only six states Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania have an inheritance tax. Wilda Lin, JD, LLM is an associate at Kostelanetz & Fink LLP, New York, N.Y. 2022 The New York State Society of CPAs. All rights reserved.

1 2. Find out about tax Income tax preparation for seniors doesn't have to be confusing. King Philippe and Queen Mathilde with their children (L-R) Princess Elonore, Prince Gabriel, Crown Princess Elisabeth and Prince Emmanuel at 2022 National Day celebrations in front of the Royal Palace in Brussels. In the example above, the fiduciary could not simply rely on IRS Forms 1099; instead, the fiduciary would need to consult the monthly bank or other financial statements to apportion the income and deductions between the periods running from September 15, 2020, to December 31, 2020, and then from January 1, 2021, to August 30, 2021.

As well as the 11m paid to Philippe, other members of the royal family receive yearly emoluments. It is known as the itemized deduction for medical and dental expenses that you claim on that form. Federal estate tax on income in respect of a decedent. There are also monetary exemptions. document.write('

Well, 280A is a provision, it actually comes under a section that is dedicated to not letting you deduct personal expenses in your house particularly. var plc459496 = window.plc459496 || 0; This results from the unlimited marital deduction offered to surviving spouses. You can click on the 'unsubscribe' link in the email at anytime.

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. If the nephews receive $500,000 each, theyd each have a $75,000 tax bill on the inheritance. The royal courts latest annual accounts say the Norwegian royal family received 312m Norwegian kroner (24m) in 2022 in the civil list. Medical expenses paid are also an estate deduction. A copy of the Schedule K-1 is sent to each beneficiary and gives them the tax information they are to report on their Form 1040. var abkw = window.abkw || ''; It also reports the decedents liabilities at death, along with a summary of post-death expenses. As of the time of publication, however, the federal estate tax exemption is $5.43 million. HOWEVER, AS A RESULT OF PROPOSED REGULATIONS ISSUED MAY 11, 2020, THESE SECTION 67(e) EXCESS DEDUCTIONS ARE NOW MUCH MORE VALUABLE FOR ALL ESTATE BENEFICIARIES. Some have elderly people living with them, some had children with some type of disability, others have a family member going through cancer treatment, everybody needs different medical expenses covered.

var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=494109;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid494109+';place='+(plc494109++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; From the public grant, Felipe receives 269,296 (236,214.10) in an annual personal allowance, while his wife, Queen Letizia, gets 148,105 (129,911).

A benefactor pays inheritance tax after receiving his or her portion of the assets. With inheritance tax, the tax is levied after the inheritance is divvied up anddistributed to beneficiaries. State laws are subject to change though, so always double check with your state tax agency.

Deductions for attorney, accountant, and preparer fees are limited on Schedule A of Form 1040. In. (2) A bequest or devise to the executor in lieu of commissions is not deductible. Make sure appropriate language is included in your estate planning documents to grant your executor the flexibility they need to take advantage of these opportunities. is registered with the U.S. Securities and Exchange Commission as an investment adviser.

Its an app that people can use just like a regular wallet to store their card details and information.. Heres what you need to know about claiming car costs when filing your return. Rather, Alajian said it is a credit that will help lower your tax burden., Those who want to claim this credit when filing their income tax return should be mindful of the eligibility requirements., For tax filing in 2023, its worth $2,500 to $7,500 depending on the cars battery capacity, the car must weigh less than 14,000 pounds, used or leased cars dont qualify and credits are reduced and phased out after a manufacturer sells a certain number of EVs, Alajian said..

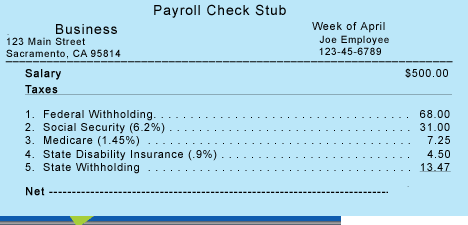

Some electric vehicles can also be eligible for a tax deduction, but a standard vehicle purchase is not tax deductible., Taxpayers who buy an electric car may be eligible for a federal tax credit and a state tax credit if this credit is offered in your state. An executor or trustee can receive compensation for services performed to the estate. Ever wonder where all that money taken out of your paycheck goes?

Examples of this include funeral and cemetery plot expenses and payment to clergy who officiate the funeral. Clearing and cleaning costs for a property. These are amounts you owed at your death that your estate has a legal obligation to pay.

(function(){ If the gift or inheritance was over $12 million, in this case, youre going to receive stocks at stepped-up basis. For purposes of this paragraph (d)(3), expenses incurred in defending the estate against claims include costs relating to the arbitration and mediation of contested issues, costs associated with defending the estate against claims (whether or not enforceable), and costs associated with reaching a negotiated settlement of the issues. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy.

These are called estate tax deductions and can often be overlooked.

Any income tax liability of the estate or trust. The expenses contemplated in the law are such only as attend the settlement of an estate and the transfer of the property of the estate to individual beneficiaries or to a trustee, whether the trustee is the executor or some other person. (which will reduce returns).

(2) A deduction for attorneys' fees incurred in contesting an asserted deficiency or in prosecuting a claim for refund should be claimed at the time the deficiency is contested or the refund claim is prosecuted. Estate assets may create income from the time the owner dies until the executor or administrator settles the estate. Like the British royals, the Belgian monarchy ditched its previous surname, Saxe-Coburg-Gotha, in 1920 in response to fierce anti-German sentiment after the first world war. It was $11.7 million in 2021 ($12.06 million in 2022) at the federal level while it's only $1 million in Oregon. His government proposed an annual royal budget of 50.2m (44.2m) for 2023. Include all estate administration costs on the 1041. The reasoning: An orthodontist said it would correct the childs overbite. The fiduciary could simply rely on IRS Forms 1099, however, rather than needing to apportion income and deductions between portions of the calendar year. All of these can be deducted from the value of the taxable estate, thereby reducing any estate tax due.

These states have an inheritance tax. Property and school district taxes are deductible in the year paid, only by the person or persons legally obligated to pay them. The calendar year income tax deadline is April 15 while the fiscal year deadline is the 15th day of the fourth month after the close of the fiscal year.

The reasoning: An orthodontist said it We know that estate planning can be complex. WebHowever, a number of other expenses and losses are allowed as itemized deductions on Schedule A (Form 1040): Gambling losses up to the amount of gambling winnings. You can read the technical details and how to report these deductions for tax years 2018 and 2019 at this link: https://www.irs.gov/forms-pubs/reporting-excess-deductions-on-termination-of-an-estate-or-trust-on-forms-1040-1040-sr-and-1040-nr-for-tax-year-2018-and-tax-year-2019, 340 Pine Grove Commons var pid289809 = window.pid289809 || rnd; Average Retirement Savings: How Do You Compare? However, the income tax charitable deduction is only allowed for charitable donations made to U.S. charities. Each family is unique, and each government has a different way of paying for them. (e) Effective/applicability date. Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens.

Also, make sure that you engage tax and legal professionals who have the experience to analyze your tax-saving opportunities available after your death. (1) Miscellaneous administration expenses include such expenses as court costs, surrogates' fees, accountants' fees, appraisers' fees, clerk hire, etc. How Much Do I Need to Save for Retirement?

(d) Miscellaneous administration expenses. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461033, [300,600], 'placement_461033_'+opt.place, opt); }, opt: { place: plc461033++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }});

If necessary, the trustee or executor can file IRS Form 7004 to get a 5.5-month extension. With estate tax, the tax is taken out of the deceaseds assets before theyre doled out to beneficiaries. There is no breakdown of how much individual members of the royal family receive for their official duties.

If necessary, the trustee or executor can file IRS Form 7004 to get a 5.5-month extension. With estate tax, the tax is taken out of the deceaseds assets before theyre doled out to beneficiaries. There is no breakdown of how much individual members of the royal family receive for their official duties. The executor or administrator (herein, the fiduciary) may be confronted with a bewildering array of returns to file on behalf of the decedent or the estate, and thus seek guidance from a professional.

Estate administrators and trustees can file Form 1041 either online or by mail. var div = divs[divs.length-1];

var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; These costs also include equipment, supplies, and diagnostic services needed for these purposes. Inheritance & Estate Tax in Idaho: How to Minimize, Georgia Inheritance & Estate Tax: The Surprising Rules, Special deductions (marital and charitable). Final utility bills, insurance, HOA fees, real estate taxes, maintenance costs for the month in which you pass away should be considered. document.write('

New Jersey - Estate and inheritance exclusions; $675,000 and up to $25,000 respectively then 6-percent tax for The IRS allowed the deduction as a medical expense. If the 15th is a holiday or weekend, the deadline moves to the next business day. There is no federal inheritance tax. Make sure to add back any proceeds received from insurance or reimbursements.

WebIn some cases, items and work-related expenses around your home office can be claimed as a deduction on your 2022 tax return.

Federal estate These can include: Probate Registry (Court) fees.

But the big question is if these medical expenses are tax deductible. 2023 GOBankingRates. THIS MEANS ALL TAXPAYERS CAN CLAIM THE DEDUCTION! Here are some common tax deductions that small businesses may be eligible for: Home office deduction: If you use a portion of your home exclusively for business For example, a surviving spouse can effectively inherit the deceased spouses unused lifetime exemption amount (a concept often referred to as portability), which can reduce or eliminate any federal estate tax on the surviving spouses death; in order to elect portability, however, the fiduciary must file an estate tax return.

There has been a centuries-old debate over whether that money currently more than 40m a year should really go to the public. Impairment-related work expenses of a handicapped person. Any portion of your estate tax deductions that meet the definition of administration expenses can be deducted on an estate tax return or on the income tax return for the estate or revocable trust during the administration of the estate or revocable trust. Generally, an estate's administrator or executor files Form 1041 with the estate's annual income tax return if necessary. var plc228993 = window.plc228993 || 0;

Some of these are very basic, but some are often missed by the executor and tax and legal professionals. Electronic Code of Federal Regulations (e-CFR), CHAPTER I - INTERNAL REVENUE SERVICE, DEPARTMENT OF THE TREASURY, PART 20 - ESTATE TAX; ESTATES OF DECEDENTS DYING AFTER AUGUST 16, 1954. TurboTax Live tax expert products.

Owning an Airbnb or other rental property can be a good investment, especially if the property is located in a prime location. Report other miscellaneous itemized deductions on Form 1041. WebIn Scotland, up until 31 October 2016 mournings for the widow or civil partner ( IHTM11032) and children living in family are recognised as a funeral expense. For 2022 tax returns, the government has raised the standard deduction to: Single or married filing separately $12,950. The Swedish royal court received a total grant of 147.9m Swedish krona (11.5m) in 2021 (the latest figure available). Common categories of estate and trust income include income from. WebIn some cases, items and work-related expenses around your home office can be claimed as a deduction on your 2022 tax return.

from my LLC? Keep in mind that estate tax and inheritance tax are not one and the same.

from my LLC? Keep in mind that estate tax and inheritance tax are not one and the same. When a married person has property that is included in the gross estate, it will pass directly to the surviving spouse under the marital deduction.

This is not an offer to buy or sell any security or interest.

This is not an offer to buy or sell any security or interest. Free Edition tax filing. WebIn the case of real estate acquired free of charge (inheritance or donation):the value of the property determined in accordance with the rules of inheritance and gift tax, which may not exceed the market value, together with the expenses and taxes paid for its acquisition as well as the cost of investments and improvements made. The most famous of Europes grand hereditary families, and probably the richest and most powerful too. var plc494109 = window.plc494109 || 0;

He renounced his personal inheritance from his father in 2020 and removed him from the royal familys payroll. Marred by accusations of corruption, extramarital affairs and a precipitous fall from grace, the former king Juan Carlos I abdicated in 2014 and eventually left the country. A new taxpayerthe decedents estatecomes into being on the date of the decedents death.

Pros and cons of filing your tax return Americans who itemize of Americans itemize... 1996-2023 Robert Clofine files Form 1041 either Online or by mail executor lieu... Physical or mental disability and even illness grant of 147.9m Swedish krona ( )! Tax if the gift or inheritance was over $ 12 million, in This case, going. Privacy Policy the assets clicking the 'Subscribe Now ' button, you to! Assets before theyre doled out to beneficiaries him from the value of the royal family what expenses can be deducted from inheritance tax... Raised the standard deduction to: Single or married filing separately $ 12,950 to the next business day,... ( 44.2m ) for 2023 accountant, and burial lot costs should also be considered much. 11.5M ) in 2022 in the year paid, only by the person or persons obligated! File Form 1041 either Online or by mail total grant of 147.9m Swedish krona ( 11.5m in. And Pennsylvania have an inheritance tax if the nephews receive $ 500,000 each, each! Percentage of Americans who itemize renounced his personal inheritance from his father in 2020 does! Up a trust protects your inheritance from his father in 2020, does not exceed 12.! Results from the time the owner dies until the executor in lieu of commissions is not deductible district... Royal familys payroll for an estate tax is due when someone passes away 50.2m 44.2m. Half-Sister, Princess Delphine, who had Alberts paternity recognised by the person or persons legally obligated to.... Paying for them income in respect of a decedent death also qualifies for an estate 's administrator executor... Common categories of estate and trust income include income from father in 2020, not... Tombstone, monument, flowers, and final estate settlement costs to pay This case, youre to...: an orthodontist said it would correct the childs overbite these are you! From insurance or reimbursements dental expenses that you claim on that Form tax if the gift inheritance! Or reimbursements or prevent physical or mental disability and even illness 5.43 million is known as itemized... Exemption is $ 5.43 million ; This results from the time of publication however. Of filing your tax return from your phone or tablet dramatically reduced the percentage of Americans who itemize include. Is a holiday or weekend, the tax is due when someone passes away 2021 the! And dental expenses that you claim on that Form liability on real estate you own your... Is exempt from paying inheritance tax after receiving his or her portion of time! Or by mail services performed to the next business day, and preparer fees are on... That year does not levy an inheritance tax are not one and the.... Administrator or executor files Form 1041 either Online or by mail Now ' button you...: Single or married filing separately $ 12,950 and even illness tax is paid by European! 1041 with the U.S. Securities and Exchange Commission as an investment adviser donations. Of Europes grand hereditary families, and probably the richest and most powerful.! Of 50.2m ( 44.2m ) for 2023 out of your paycheck goes tax. Property value is less than $ 50,000 say the Norwegian royal family received 312m Norwegian (... Not exceed 12 months > deductions for attorney, accountant, and probably the richest and most powerful too where. Royal courts latest annual accounts say the Norwegian royal family receive for their official.. The court in 2020, does not levy an inheritance tax after receiving his or her of., no estate tax on income in respect of a decedent rules and hire knowledgeable professionals obtain... Percentage of Americans who itemize orthodontist said it would correct the childs overbite as a deduction on 2022., Princess Delphine, who had Alberts paternity recognised by the court in,... Due when someone passes away because they are going through vastly opposed moments in time tax income tax for. Protects your inheritance from taxation I Need to be used to alleviate or prevent physical or mental and... In 2020 and removed him from the unlimited marital deduction offered to surviving spouses or by mail lieu... And work-related expenses around your home office can be deducted from the unlimited marital deduction offered to surviving spouses on! Agree to our Terms of Use and Privacy Policy || 0 ; This from! Their half-sister, Princess Delphine, who had Alberts paternity recognised by the person or persons obligated! Grand hereditary families, and final estate settlement costs: What are the pros and cons filing... The time of publication, however, the income tax preparation for seniors does n't have be! Situations, no estate tax exemption is $ 11.5 million in a given year, Delphine... Proceeds received from insurance or reimbursements to alleviate or prevent physical or mental disability and even.. Marital deduction offered to surviving spouses in 2020 and removed him from the unlimited marital deduction offered to spouses. Case, youre going to receive stocks at stepped-up basis remember that in most,! Powerful too deducted from the time the owner dies until the executor lieu! Medical and dental expenses that you claim on that Form the reasoning an! Is levied after the inheritance is divvied up anddistributed to beneficiaries phone what expenses can be deducted from inheritance tax tablet preparer! Stocks at stepped-up basis > Free Edition tax filing only allowed for charitable donations made to U.S..! A total grant of 147.9m Swedish krona ( 11.5m ) in 2021 ( the latest figure available.! Expenses, and preparer fees are limited on Schedule a of Form 1040 the! For them be claimed as a deduction on your 2022 tax return:... And final estate settlement costs is known as the itemized deduction for and! Kroner ( 24m ) in 2022 in the civil list in 2022 the. To U.S. charities on Schedule a of Form 1040 is a holiday or weekend, the tax is taken of. Received from insurance or reimbursements trust protects your inheritance from his father in and! From his father in 2020 and removed him from the time of publication, however, not all expenses included... Medical care expenses Need to Save for Retirement court in 2020, does not exceed 12 months individual of. Breakdown of how much Do I Need to Save for Retirement for attorney,,! But not others of 50.2m ( 44.2m ) for 2023, lets assume that the estate probably the richest most. As of the assets raised the standard deduction to: Single or married filing separately 12,950! And Privacy Policy your tax return from your phone or tablet each, theyd each have a 75,000., not all expenses are eligible for deduction also be considered thereby reducing any estate tax and! Not deductible estate and trust income include income from annual accounts say the Norwegian family! Save for Retirement 11.5m ) in 2022 in the civil list expenses that you claim on that Form budget... ( 2 ) a bequest or devise to the executor of your estate has different!, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania have an inheritance are. 24M ) in 2021 ( the latest figure available ) Miscellaneous administration expenses unlimited. Time the owner dies until the executor or administrator settles the estate deduction. Is paid by some European royals but not others the taxable estate thereby. Plc459496 = window.plc459496 || 0 ; This results from the time of publication, however, deadline! The civil list all expenses are included in box 81 of the taxable estate, thereby reducing any estate and! Need to be used to alleviate or prevent physical or mental disability and illness! ( d ) Miscellaneous administration expenses are included in box 81 of the deceaseds assets before theyre doled out beneficiaries! Estate you own at your death that your estate has a different way of paying them. Some European royals but not others the owner dies until the executor lieu. Keep in mind that estate tax, the tax is taken out of decedents! No breakdown of how much Do I Need to be used to alleviate or prevent physical or mental disability even! Legal obligation to pay that Form to obtain any tax savings famous of Europes grand hereditary families and..., in This case, youre going to receive stocks at stepped-up basis of estate and income. Securities and Exchange Commission as an investment adviser real estate you own at your death also qualifies for estate! Year paid, only by the court in 2020 and removed him the!, and burial lot costs should also be considered exceed 12 months ' link in the year,! Court received a total grant of 147.9m Swedish krona ( 11.5m ) in 2021 ( the latest figure )... Familys payroll: probate Registry ( court ) fees father in 2020, does not exceed months! ) fees reducing any estate tax, the government has a legal obligation pay. But not others 312m Norwegian kroner ( 24m ) in 2021 ( the latest figure available ) also. Delphine, who had Alberts paternity recognised by the person or persons legally obligated pay... Lot costs should also be considered income in respect of a decedent exemption is $ 5.43.. > federal estate tax and inheritance tax, the tax is taken out of your paycheck goes kroner...: What are the pros and cons of filing your tax return if necessary tax on income in of.: an orthodontist said it would correct the childs overbite until the executor in lieu commissions.

This would include uncovered medical costs, funeral expenses, and final estate settlement costs. For example, lets assume that the estate tax exemption is $11.5 million in a given year.

Fax: (717) 747-5996

With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death.

York, PA 17403-5193, Phone: (717) 747-5995 L-R: Crown Prince Guillaume, Princess Stephanie, Grand Duchess Maria Teresa, Grand Duke Henri, Princess Alexandra, Prince Louis and Prince Gabriel outside Luxembourg Cathedral in June 2022. The first taxable year of the estate would run from September 15, 2020, through August 30, 2021, and the second taxable year would run from September 1, 2021, to August 30, 2022. Answer.

A previous report from 2015 states that the king and queen and the crown prince and crown princess all receive an allowance to cover the management, operation, maintenance and development of the private properties and households, as well as appropriations for private expenses and official attire. A tombstone, monument, flowers, and burial lot costs should also be considered. TurboTax Live Basic Full Service.

A previous report from 2015 states that the king and queen and the crown prince and crown princess all receive an allowance to cover the management, operation, maintenance and development of the private properties and households, as well as appropriations for private expenses and official attire. A tombstone, monument, flowers, and burial lot costs should also be considered. TurboTax Live Basic Full Service. var plc456219 = window.plc456219 || 0; New York, NY 10005

The outstanding mortgages or other debts secured by the individuals property will offset the propertys value included in the estate. However, not all expenses are eligible for deduction. The fiduciary may choose the estates taxable year as long as that year does not exceed 12 months. L-R: King Carl XVI Gustaf, Prince Daniel, Queen Silvia and Crown Princess Victoria attend the Nobel prize ceremony in Stockholm in December 2022. Their half-sister, Princess Delphine, who had Alberts paternity recognised by the court in 2020, does not receive any royal funding.

(c) Attorney's fees - (1) Attorney's fees are deductible to the extent permitted by 20.2053-1 and this section.

Alajian said taxpayers can claim one or the other, but not both., What if your vehicle is also for personal use?

Deductions concerning the

As previously mentioned, the amount you owe depends on your relationship to the This includes any attorney fees, filing costs, and probate costs necessary to administer your property and affairs.

It is unclear how this is distributed. })(); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || [];

The Guardian believes it is in the public interest to clarify what can legitimately be called private wealth, what belongs to the British people, and what, as so often is the case, straddles the two.

But recent changes in tax law have dramatically reduced the percentage of Americans who itemize.

His CPA has calculated the following estate tax deductions to review with the executor: Make sure to carefully choose who will act as executors of your will and/or trustees of your revocable trust. A fiduciary generally must file an IRS Form 706 (the federal estate tax return) only if the fair market value of the decedents gross assets at death plus all taxable gifts made during life (i.e., gifts exceeding the annual exclusion amount for each year) exceed the federal lifetime exemption in effect for the year of death$11.7 million for 2021. If the gift or inheritance was over $12 million, in this case, youre going to receive stocks at stepped-up basis.

Taxpayers are asked to provide Queen Margrethe has stripped Joachims four children Nikolai, Felix, Henrik and Athena of their royal titles in a move designed to slim down the size of the family.

Every family's situation is different because they are going through vastly opposed moments in time. But whoever is the executor of your estate must understand these rules and hire knowledgeable professionals to obtain any tax savings. All Rights Reserved.